Solution: Localised Microfinancing

Sectors: Livelihoods, Education, Equality, Business

Sub Sectors:

* Livelihoods: Business Set up, job creation

* Equality: Access to education

In this tab we provide a full summary of the solution

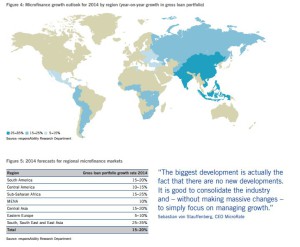

■ The investable microfinance sector is set to grow by between 15% and 20% in

2013, in line with our previous forecasts. There is much to suggest that the sector

will maintain this growth rate in 2014.

■ responsAbility uses a portfolio of 100 microfinance institutions (MFIs) to track the investable

microfinance sector from a quantitative perspective. In addition, we completed

interviews with 30 regional experts to evaluate the market in qualitative terms.

Based on these two approaches, we forecast growth of 15% to 20% in 2014.

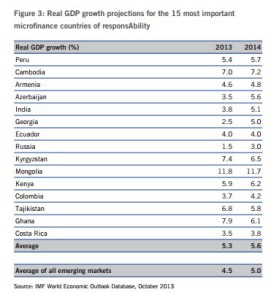

■ In terms of macroeconomic growth, all regions are expected to perform better in 2014

than in 2013. According to the International Monetary Fund (IMF), average real

GDP growth in the 15 most important microfinance markets worldwide will increase

from 5.3% in 2013 to 5.6% in 2014.

■ Experts believe that gradual improvements in market infrastructure are helping to drive

the expansion of the microfinance sector. These improvements include the emergence

of credit bureaus that provide transparency about the creditworthiness of borrowers.

■ Due to their visible success and vast client base, local microfinance sectors continue

to attract the attention of politicians whose short-term agendas are rarely aligned with

the interests of end-clients, companies and investors. Strong diversification and risk

monitoring therefore remain a priority.

In this section we provide a log of the various technologies related to this solution

ADBanking Software Review

In this section we provide a log of various research undertaken throughout the world which is related to thsi solution.

Examining Microcredit through the Behavioral Lens

http://www.microfinancegateway.org/library/examining-microcredit-through-behavioral-lens

Generating Returns through Development Finance 2014: Impact Investment Report

In this section we provide a list of case studies related to this development solution.

Mobile Money for Empowerment Muslim Women Entrepreneur: Evidence from Asia (Indonesia and Bangladesh)

Is Health Microinsurance Sustainable? An Analysis of Five South Asian Schemes

In this section we provide a list of “How To” or tasklist to implemention or part implementation to this development solution.

Business Plan to Start Up a Microfinance Institution in …

Transformation into a Microfinance Company (MFC) . …. Between 1999 and 2002 the economy picked up by an average of 6 % and by 2007 the ….. branches, and settingrequirements relating to the compensation, hiring, and termination.

India is currently considered the largest emerging market for microfinance institutions (MFIs). Commonly described as the bank for the poor, MFIs offer three basic services: savings, credit and insurance. Setting up an MFI is not a Herculean task – provided your priorities are clear.

Before setting up a microfinance institution, it is imperative to come to a decision about one basic premise: do you want your MFI to be a non-profit or a for-profit institution?

Non-profit MFIs are set up as trusts or societies with the aid of grants and donations, registered under the Societies Registration Act, 1860, or the Indian Trust Acts, 1882. In fact, most such MFIs started out as NGOs.

If you decide to setup a for-profit MFI, there are two models to choose from: a non-banking financial company(NBFC) or a co-operative. Unlike an NBFC, a co-operative is entitled to take on savings accounts. A co-operative brings with it ownership, your customers are also owners.

Get a License from RBI

If you are setting up an NBFC, the Reserve bank of India (RBI) is the only authorized body that’s registered to grant youo a license. For this, you will need to raise Rs. 2 crore in capital. The process usually takes three to four months. You can also buy existing licenses of defunct companies from the RBI. This should cost you onwards of Rs. 25 lakh. Check http://www.rbi.org.in for more information. To obtain a license for a co-operative, contact the Registrar of Companies.

Decide your operational model

Most MFIs use groups for the intermediary financial transactions. But there are different way in which you can work with these groups. MFIs are broadly classified into two models: Self Help Groups (SHGs) and the Grameens. You must also decide the financial and non-financial services that you will be willing to offer. To better understand your customers, conduct a market survey. Also, it is advisable to run a pilot program for around 1 year, which will help you build the cohesion and helps you better tailor your products and services to your clientele.

– You may require 5-6 field workers, people who actually meet and interact with the target customers. It is advisable to choose the field workers with ethnic profile from your customer base.

– You may require few people to look after the accounts, and manage the MSME.

Get a bank loan

MFIs fall under the ‘priority sector‘ identified by the Government of India. The pilot program helps to gain the bank’s trust and put you at an advantage as you approach the banks. As always in business, it is advisable to source your funds from two to three different banks. Below are a few links that may be useful:

RBI revises priority sector lending norms

This post will be followed up with more details about the operational models of MFI.

In this section we provide a list of useful videos to this development solution.

In this section we provide a forum where all users can post questions, gain feedback and discussed with others related to this development solution.

In this section we provide a list of pitfalls experience to implemention to this development solution.

- Simplicity is difficult to accept. For some people it’s difficult to accept simple solutions. The PPI as a simple tool raises some barriers which makes its acceptance difficult.

- Can poverty be measured with 10 questions? A lot of people have asked this question. The PPI uses 10 non-financial, verifiable indicators to measure poverty. It must be explained that these are proxy indicators with attached values and a poverty look-up table to score those values–to measure the likelihood of poverty each score indicates. In summary, the PPI consists of 10 proxy indicators with scores attached to values measured by poverty likelihood tables. So the PPI is NOT just 10 questions.

- The gaps between PPI results and the results from an MFI’s own poverty measurement tool raise questions. Mostly MFIs are surprised to see the gap between PPI results and the results from their own poverty measurement tool. The PPI measures poverty for different poverty lines, e.g. national poverty line, food poverty line, US$1.25/day PPP, etc. Before an MFI compares PPI results with the results of its tool, it must find out where its poverty tool fits in terms of poverty line(s). Does the MFI’s poverty tool measure poverty for the national poverty line or US$1.25/day PPP? You need to compare apples with apples.

- Strong ownership by the MFI for its own poverty measurement tool. Some MFIs are reluctant to abandon their own tools although they know that the responses to questions are inflated, and the results are not accurate due to the subjectivity and non-verifiable nature of the questions.

- The PPI is developed from an old (2 or more years) national socio-economic survey. So people think that the PPI is not reflective of the current situation. But the old national survey is the latest available survey and, in the absence of new national survey, the PPI can’t be revised. Remember that the government is also using the results of the old national survey for its own purposes, which means it is still highly relevant.

- The PPI doesn’t fit with all extreme situations. Just like any other tool. People like to think about extreme situations in general to demonstrate that the PPI doesn’t work in these extreme cases. But, like any other tool, the PPI is not perfect; there will always be exceptions (outliers). But such exceptions will always be a tiny percentage and it’s immaterial to worry too much about them. The impact of such extreme cases on the accuracy of the results will be almost none.

- Top management and board lack understanding of the PPI. It’s key for top management and the board to develop an appropriate understanding of the PPI. The MFI should make a systematic effort to build this understanding; if they do not understand, they will not commit.

- Social performance is just a talk and not the walk. The PPI supports MFIs in achieving their social missions. But in the case of some MFIs, achieving their social mission is limited to talk only without serious actions.

- The MFI lacks the capacity to interpret PPI results. Often PPI results don’t match the expectations of the institutions. The MFI must be clear when it interprets the PPI results. For example, the MFI needs to break down a consolidated result like “30% of clients are below the national poverty line” into loan cycles as financial services may help reduce poverty of clients in higher loan cycles.

- How does the PPI make a business case? There’s a need to develop evidence that shows how the PPI contributes to the reduction of over-indebtedness, increases profits, expands market share, etc. Research and case studies should demonstrate that the PPI is not limited to social performance only but is also vital for pure business, which it is.

– See more at: http://www.progressoutofpoverty.org/blog/top-ten-ppi-challenges-barriers-faced-mfis#sthash.8GTvpIsa.dpuf